The perfect storm is about to end: meet Braskem, not your average petrochemical company

Trading at 4x EV/EBITDA, Braskem seems overly discounted after a 4-year perfect storm: environmental issues, petrochemical downcycle and low utilization rates. Are we near the end?

If we told you there is a multinational petrochemical company based in Brazil with a record of poor corporate governance, bad ESG press, going through a tough downcycle and underwhelming utilization rates, you would probably think this is a short pitch. But its not!

Meet Braskem SA, the biggest petrochemical company of Brazil. Founded in 2002, Braskem was built through a series of acquisitions made by Odebrecht group to consolidate the petrochemical sector in Brazil, with the most emblematic one being the US$ 4 billion acquisition of Grupo Ipiranga in 2007, marking the beggining of the shareholder agreement between Odebrecht and Petrobras (the sole supplier of naphta to Braskem).

Following this hallmark buyout, petrochemical upcycle and governmental support, Braskem also started their internationalization process with a Mexican JV with Idesa in 2009 and the 2011 acquisition of Dow Chemical’s polypropylene (PP) assets in USA and Germany, becoming the largest producer of polypropylene in the United States.

But things rapidly started to change in 2014, when the brazilian economic downturn together with new US polypropylene capacity began to hit PP prices. And this is where things start to be interesting:

The Car Wash operation - an anti-corruption probe - revealed in early 2016 that Braskem paid bribes to key Petrobras executives to have their conditions accepted in their long-term naphtha supply agreements; and Odebrecht’s key executives were also involved in briberies of top politicians and corruption schemes to be awarded multi-million construction concessions.

Those charges led to the arrest of key executives of Odebrecht (including CEO Marcelo Odebrecht) and Braskem (ex-CEO José Grubisich); and Odebrecht filing under Chapter 11 in June 2019, the biggest in brazilian corporate history (for a comprehensive read on this topic, I highly suggest this The Guardian piece).

So, as you can see, Braskem involvement in corruption scandals together with their bankrupt owner, while going through a downcycle was the perfect storm for one of the ‘national-leaders’ companies in Brazil. And, to complete their nightmare, in early 2019 the company was charged for severe environmental damages in a neighbourhood in Maceio, the capital of Alagoas state in brazilian northeast.

But given our special situations background and our contrarian hearts, we think now its the perfect time to buy an operationally well-rounded company in the deepest moment of the commodity cycle.

Nowadays Braskem remain as the indisputed leader in the petrochemical market in Brazil and remains as the largest polypropylene producer in North America. Their operations can be broke down in their three end-markets:

Brazil (~60% of Revenues) segment includes production and sale of chemicals and polyethylene (PE);

The USA and Europe (~30% of revenues) segment involves production, operation, and sale of polypropylene (PP) mainly in the United States and Germany; and

Mexico (~10% of revenues) segment comprises BraskemIdesa operations, focused on production, operation, and sale of ethylene and polyethylene.

Why we think this is the best moment to buy the stock?

#1 Trigger: The worst is behind us.

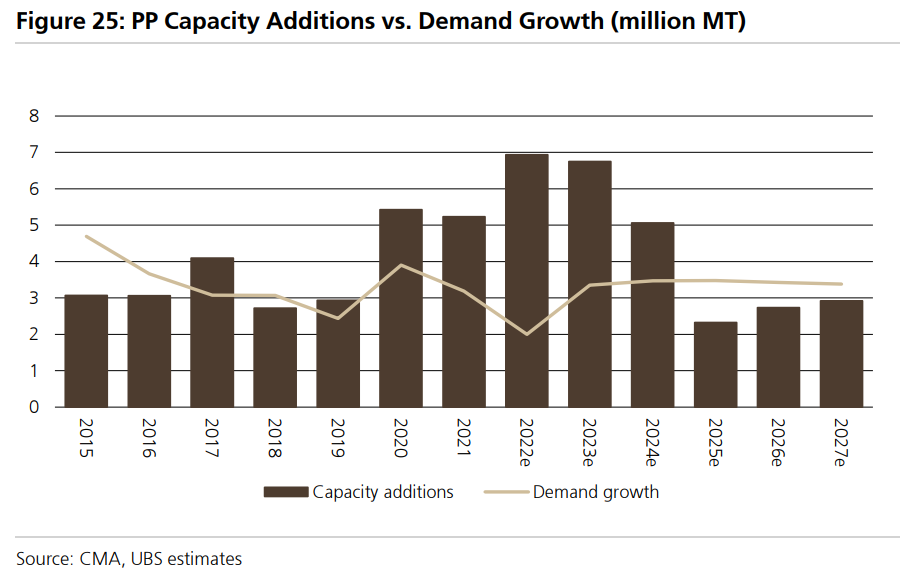

Braskem 4Q showed significant compression of PP spreads: 12% qoq contraction in Brazil and 18% in the US, mainly due to an increase in capacity, with the most recent ones coming from Heartland Polymers (525k tons per year) and ExxonMobil (450k tons per year). But other than that, there's only a 250k capacity addition in 2024 from Formosa Plastic, therefore we shouldnt expect further capacity additions in north american market. The current downcycle led Braskem’ utilization rates to fall to 72% and one of their worst EBITDA in recent years. So we are strongly supportive of the thesis that the worst is behind us, both in terms of oversupply and of slowing demand.

#2 Trigger: Good old Petrobras’ back, baby!

Lula’s last term was marked by huge support to the O&G chain, as the president deem highly the sector to spur economic growth and was key supporter of Petrobras stake in Braskem post-Ipiranga deal. Therefore, we understand that Lula & Petrobras are interested to turnaround Braskem despite Odebrecht (rebranded as Novonor) issues. And given that Braskem has also been investing in environmental initiatives (energy transition), it would fit perfectly into Petrobras ‘back-to-basics’ narrative and its possible that Petrobras is interested to buy the control from Novonor, pressured by their debtholders to emerge out of Chapter 11. So, either Novonor finds a way out of Braskem, or…

#3 Trigger: Hefty Dividends on the way?

…Braskem has to pay huge dividends in order to Novonor pay down their debts. Braskem is the crown jewel of the group, and even amid the lowest cycle periods, the company should be able to generate R$ ~700mn in FCFE (9% yield). For the coming years, the fine instalments related to the Alagoas accident will be significantly lower (~R$1bn), and FCF yield should average ~20%. In terms of leverage, Braskem has been aiming to keep Net Debt/EBITDA within 2.0-2.5x, enough space for higher payouts.

#4 Trigger: Buyout offers everywhere

Braskem have had multiple buyout offers in the last couple of years due to Novonor’ struggles and their unique position in LatAm petchem chain:

In Jun’2018, LyondellBasell (NYSE:LYB) and Novonor entered into an exclusivity agreement for the sale of Braskem. This deal had lots of merits, specially the synergies between LYB Mexico and Braskem Idesa. Unfortunately, the Maceio incident and the Atvos’ Chapter 11 filing (Novonor S&E sub) collapsed the deal;

Following the collapse of LYB deal, Novonor allegedly mandated Morgan Stanley in early 2021 for the selling proccess, with indications of interest from Advent, Mubadala, BTG Pactual’ Private Equity arm and Unipar Carbocloro. Given the complex nature of the deal inside of Novonor’s Chapter 11 discussions, from our understanding only Apollo offer went through the final steps.

In Oct’2022, private equity firm Apollo offered R$50/share for Braskem, according to multiple reports. At the time, we even tweeted that it seemed odd given elections were right around the corner and Novonor was betting high stakes in Lula’s election.

After four years of intense dispute, from our understanding Novonor is running out of time in their discussions with debtholders and Braskem’ stake is in play. For instance, the debtholders had to took control of Novonor’s S&E crusher Atvos and later sold it to UAE’s sovereign fund Mubadala, who has also bought out recently some refineries from Petrobras.

Valuation

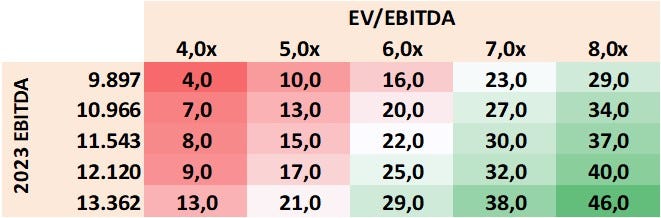

As soon as the sky clear throughout the 2H23, we see space for Braskem increasing their utilization rates and, with healthy spreads, we expect an $11.5b EBITDA for this year, so Braskem is currently trading at 4x EV/EBITDA 2023, well below listed peers. As we move further into the year, a multiple re-rating closer to the peer comp median 6x EV/EBITDA would represent a +150% upside from current BAK 0.00%↑ ($8.90 per BAK or R$21.60 per BRKM5):

Moving further into 2024, Braskem would be trading at 11% FCF yield with an expected +5% dividend yield in dollar terms, making the thesis an compelling play amid current environment.